Introduction

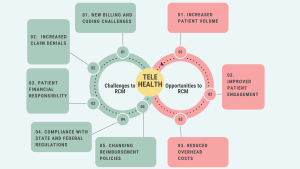

Telehealth has revolutionized the healthcare industry, offering convenience, accessibility, and improved patient outcomes. However, as telehealth becomes more widespread, it has introduced new challenges and opportunities in Revenue Cycle Management (RCM). The shift to virtual care has impacted billing, coding, reimbursement, and compliance, requiring healthcare providers to adapt their RCM processes to navigate this evolving landscape.

In this blog, we’ll explore the ways telehealth affects RCM, the challenges it presents, and actionable strategies to optimize telehealth billing and reimbursement processes.

The Rise of Telehealth in Healthcare

The COVID-19 pandemic accelerated the adoption of telehealth, with providers leveraging virtual care to ensure patient safety and continuity of care. Post-pandemic, telehealth remains a vital part of healthcare delivery, with many patients preferring virtual consultations for routine and follow-up visits.

This rapid adoption, while beneficial, has necessitated changes in how healthcare organizations manage their revenue cycles. From billing complexities to payer regulations, telehealth has redefined the traditional RCM framework.

Key Impacts of Telehealth on Revenue Cycle Management

1. New Billing and Coding Challenges

Telehealth services require the use of specific codes, such as CPT and HCPCS modifiers, to denote virtual care. Missteps in applying these codes can lead to claim denials and revenue loss.

- Example: CPT code 99441-99443 is often used for telehealth consultations. If improperly coded or lacking necessary modifiers (e.g., GT or 95), claims may be rejected.

2. Changing Reimbursement Policies

Reimbursement for telehealth services varies significantly among payers. While Medicare and many private insurers expanded telehealth coverage during the pandemic, reimbursement rates for telehealth may differ from in-person visits. Providers must stay updated on payer-specific policies.

3. Patient Financial Responsibility

Patients may face confusion regarding their financial obligations for telehealth services, especially if deductibles or copays differ from traditional visits. This can lead to delays in collections and reduced cash flow.

4. Compliance with State and Federal Regulations

Telehealth services are subject to state-specific licensing laws, federal regulations like HIPAA, and evolving guidelines from agencies like CMS (Centers for Medicare & Medicaid Services). Compliance issues can lead to penalties or denied claims.

5. Increased Claim Denials

Due to the complexities of telehealth billing and documentation requirements, many providers experience a higher rate of claim denials compared to in-person services.

Strategies to Optimize Telehealth Revenue Cycle Management

To maximize revenue and minimize disruptions, healthcare organizations must adapt their RCM processes to meet the demands of telehealth. Here’s how:

1. Master Telehealth Billing and Coding

- Stay Updated: Regularly review updates to telehealth billing codes and payer policies.

- Use Modifiers: Ensure accurate use of modifiers like GT (via interactive audio and video) and 95 (synchronous telemedicine).

- Train Staff: Provide specialized training for billing teams to handle telehealth claims effectively.

2. Streamline Documentation

Accurate and thorough documentation is critical for telehealth claims.

- Include location of service, technology used, and patient consent in medical records.

- Ensure providers document services in compliance with payer requirements to avoid denials.

3. Verify Insurance Eligibility

Before appointments, verify:

- Telehealth coverage under the patient’s insurance plan.

- Patient responsibility for co-pays, deductibles, and coinsurance.

4. Use Technology to Enhance RCM Processes

- Implement RCM software with telehealth-specific billing features.

- Use automated eligibility verification tools to confirm patient coverage in real time.

- Leverage analytics to track telehealth claims performance and identify denial trends.

5. Educate Patients About Telehealth Costs

- Clearly communicate telehealth billing policies, co-pays, and deductibles to patients before appointments.

- Provide online payment options for convenience and timely collections.

6. Stay Compliant with Regulations

- Ensure providers are licensed to deliver telehealth services in the patient’s state.

- Adhere to HIPAA guidelines for telehealth platforms to protect patient data.

- Monitor updates from CMS and state regulators regarding telehealth reimbursement policies.

Opportunities Telehealth Brings to RCM

Despite the challenges, telehealth also offers unique opportunities to enhance RCM processes:

- Increased Patient Volume: Telehealth allows providers to reach patients in remote areas, increasing patient volume and revenue potential.

- Reduced Overhead Costs: Virtual care reduces expenses associated with physical infrastructure, such as office space and utilities.

- Improved Patient Engagement: Patients appreciate the convenience of telehealth, leading to higher satisfaction and loyalty.

Conclusion

Telehealth has transformed healthcare delivery, offering convenience and accessibility to patients while presenting new challenges for Revenue Cycle Management. By mastering telehealth billing codes, streamlining documentation, verifying insurance eligibility, and leveraging technology, healthcare providers can optimize their RCM processes and maximize revenue.

Staying compliant with state and federal regulations, such as HIPAA, ensures providers protect patient data while maintaining reimbursement integrity. As telehealth continues to evolve, proactive RCM strategies will be essential for healthcare organizations to thrive in the digital era.